Enterprise valuation is needed in following occasions:

EVaaS (Enterprise Value-as-a-Service) packages

Choose a package that suits with your company's status and

the purpose of valuation

EXPRESS

2 - 3 working days

€1 900 - 2 500

subject to company's size & complexity

Company's profile / situation:

Valuation methods:

Package includes:

Special Offer €3 900

MEDIUM

5 - 9 working days

€4 900 - 7 500

subject to company's size & complexity

Company's profile / situation:

Valuation methods:

Package includes:

FULL

15 - 35 working days

€12 000 - 15 000

subject to company's size & complexity

Company's profile / situation:

Valuation methods:

Package includes:

Special Offer €2 500

START-UP

3 - 5 working days

€2 900 - 4 500

subject to company's size & complexity

Company's profile / situation:

Valuation methods:

Package includes:

* Depends on availability of comparable data in relevant databases

All prices are subject to applicable VAT

A 20% downpayment may apply to confirm your order

If necessary, ask for the T&C of the EVaaS service. For certain packages of the EVaaS service, limitations of liability applies to the use of valuation results due to the availability of input data or the limited quality of the reference and input data.

Process of enterprise valuation

Read more:

Discover entire portfolio of our business services

M&A transaction advisory, investors' search

- Capital raise (equity & debt capital, issue of bonds etc.)

- Acquisitions

- Sales and exits

- Mergers and strategic partnerships

Business and financial consultancy

- Enterprise valuations

- Strategic and business planning

- Corporate finance and management consulting

- M&A Manager-as-a-Service

Legal advisory and data protection

- Legal advisory in M&A transactions

- Legal Due Diligence (LDD)

- Data protection and GDPR consultancy

- DPO-as-a-Service

TMT Capital Academy

- Training courses, seminars, webinars

- Individual courses to the company / management

- Management training and coaching

About us

TMT Capital is an international network of experienced experts in M&A advisory and corporate finance (CF), in strategy, business and management as well as legal, regulatory and data protection (GDPR) consultancy. We focus on growth and mid-cap companies with a value of up to €200 million, including start-ups. We are industry-agnostic, with a focus on TMT market verticals (telecom, IT, media, technology).

TMT Capital experts have extensive and long-term experience as entrepreneurs, investors, senior managers and/or consultants in the TMT sectors, and we operate in various investment, M&A and other advisory firms in the Baltics, Europe and beyond. We collaborate and combine our knowledge and strengths on a project-by-project basis.

Partner for the company throughout its entire life cycle

In partnership with:

Our experts

Pete

Gary

Andrejs

Merit

Arno

Margus

Michael

Raivo

Our experts' network includes partners who work daily in Estonia, Latvia, Great Britain, Finland, Israel, Poland, the Czech Republic, Germany, Canada, the USA and elsewhere.

For larger projects, we assemble a team with the necessary competence and size based on our own network, and therefore we are able to conduct larger cross-border transactions.

The following data and reports are needed for enterprise valuation:

EXPRESS

MEDIUM

FULL

START-UP

TMT Capital ensures the confidentiality of all received data, reports, questionnaires, etc. and destroys or returns the corresponding data and reports upon completion.

Complete list of features and options of all EVaaS packages

| Express | Medium | Full | Start-up | Additional one-off fee | |

|---|---|---|---|---|---|

| STATUS OF THE COMPANY / SITUATION: | |||||

Concept / Pre-reven ue company | X | X | X | + | |

Start-up company (1-3 yrs) | X | X | X | + | |

Scale-up / growth company | + | X | X | + | |

Mature company, private (3+ yrs) | + | + | + | X | |

Mature company, public (3+ yrs) | + | + | + | X | |

Restructuring | + | + | + | X | |

Liquidation | + | + | + | X | |

| VALUATION METHODS USED: | |||||

Transaction comparables* | + | + | + | X | |

Trading comparables* | + | + | + | X | |

DCF WACC simplified | X | + | + | O | €1 500 .00 |

DCF WACC dynamic | X | + | + | X | |

DCF APV (Adjusted Present Value) | X | + | + | X | |

DDM (Dividend Discount Model) | X | O | + | X | €900 .00 |

Capitalized earnings | X | O | + | X | €900.00 |

Leveraged Buy-out (LBO) | X | O | + | X | €900.00 |

VCM (Venture Capital Method) | X | O | O | + | €900.00 |

| FEATURES AND VALUATION DRIVERS USED: | |||||

Asset turnover | + | + | + | X | |

Return on Assets | + | + | + | X | |

Return on Equity | + | + | + | + | |

DuPont analysis (analysis of value drivers) | X | X | + | X | |

Peer Group analysis | + | + | + | O | €1 500 .00 |

Benchmarking | + | + | + | O | €900.00 |

Normalizations (revenues, opex, EBITDA etc.) | X | + | + | X | |

Semi-automatic forecasting | X | + | + | + | |

AI-based forecasting (historical data, KPIs etc.) | X | O | + | X | €900.00 |

Multi-scenario analysis | X | O | O | X | €1 500 .00 |

Analysis of ESG implication to EV (WACC) | X | O | O | X | €2 500.00 |

EV report (pdf) | + | + | + | + | |

Valuation presentation and suggestions (max 1-2 h) | + | + | + | + | |

| INPUT DATA NEEDED: | |||||

Profit & Loss Statements (1-3 years) | + | + | + | O | |

Balance Sheets (1-3 years) | + | + | + | O | |

Cash Flow Reports (1-3 years) | + | + | + | O | |

Annual Reports (1-2 years) | O | + | + | O | |

Detailed Management Reports (1-3 years) | O | O | + | O | |

High-level forecasts / growth KPIs (revenues, COGS, opex, capex) | + | O | O | + | |

Business plan with financial projections, 3-5 years | O | + | O | O | |

Detailed business plan with financial projections and KPIs (3-5 years) | O | O | + | O | |

Questionnaire - Qualitative Assessment of the company | + | + | + | + | |

Questionnaire - ESG | X | O | O | X | |

Other data or reports, subject to releveance | O | O | O | O | |

Additional workload (exceeding amount in package), Partner, hourly rate | O | O | O | O | €135.00 |

Additional workload (exceeding amount in package), Director, hourly rate | O | O | O | O | €95.00 |

| Additional workload (exceeding amount in package), Analyst, hourly rate | O | O | O | O | €55.00 |

All of the prices of EVaaS packages and additional services are subject to the value-added tax (VAT) applicable in the Republic of Estonia.

Any need for additional workload shall be agreed upon in advance with the client, and payment will be based on timesheets submitted to the client.

For the Express and Medium packages of the EVaaS service, limitations of liability apply to the use of valuation results due to the varying quality of input data. For more information regarding the limitations on the use of the work, please consult a TMT Capital expert.

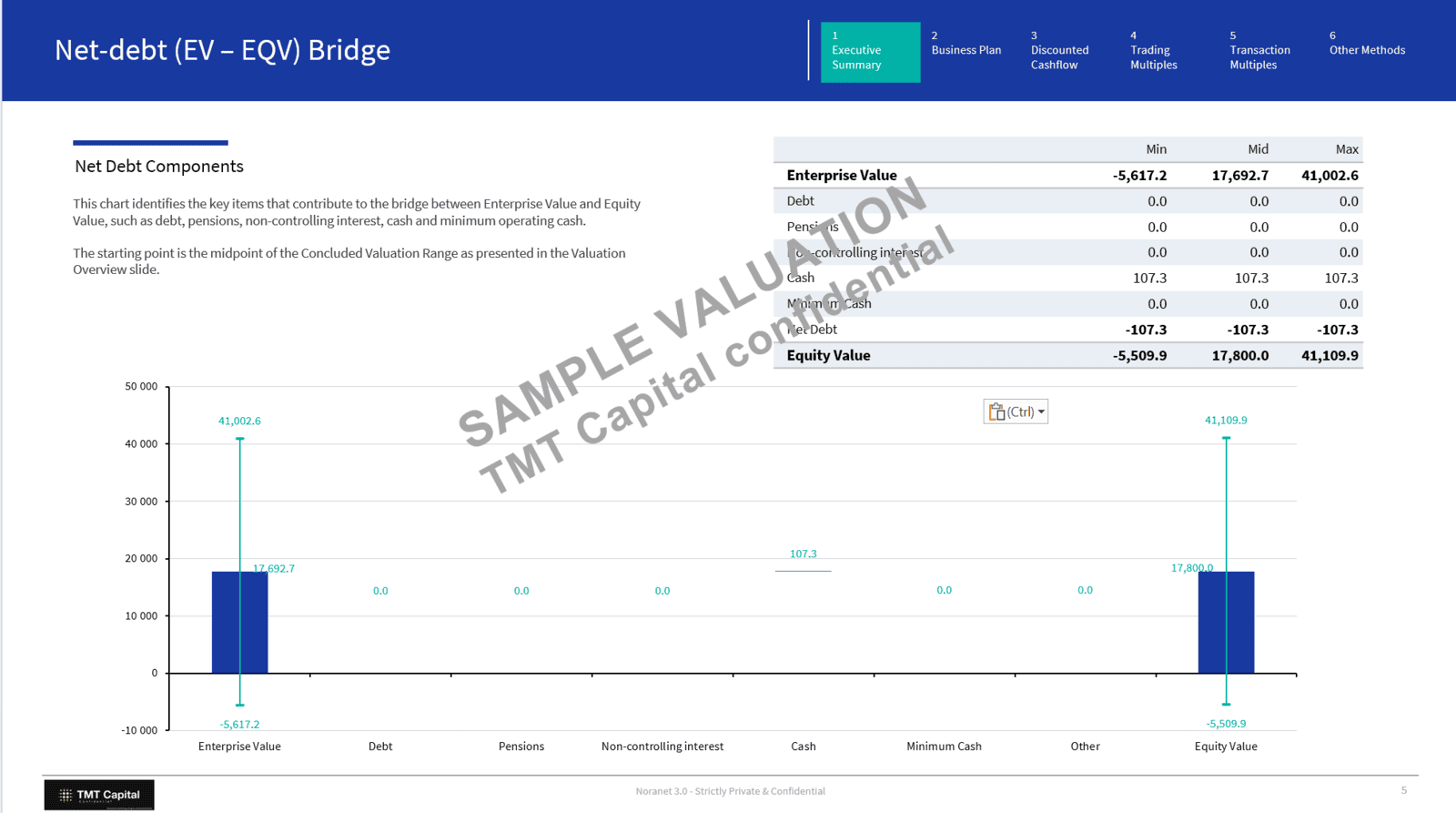

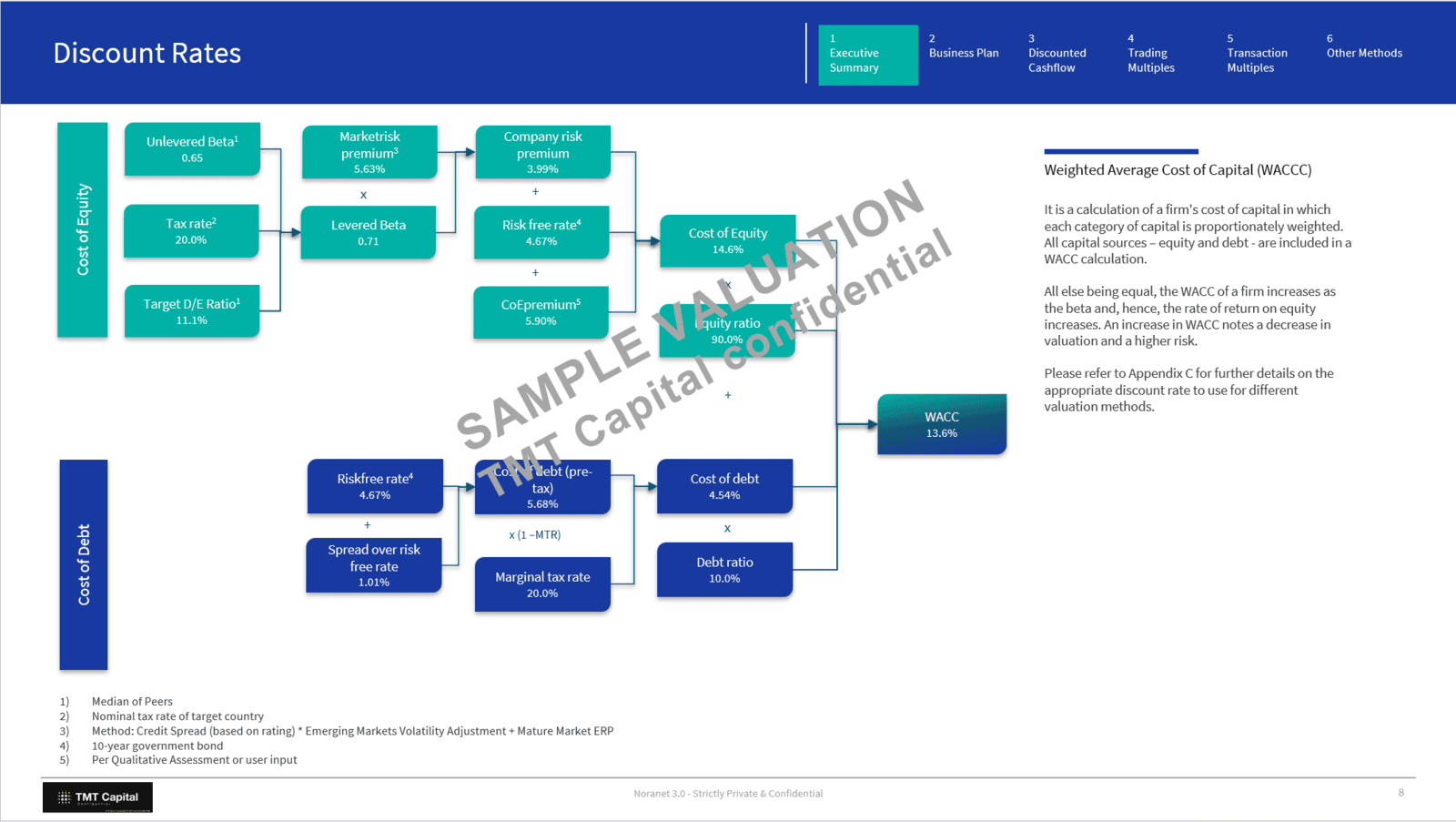

Sample of valuation report of EVaaS

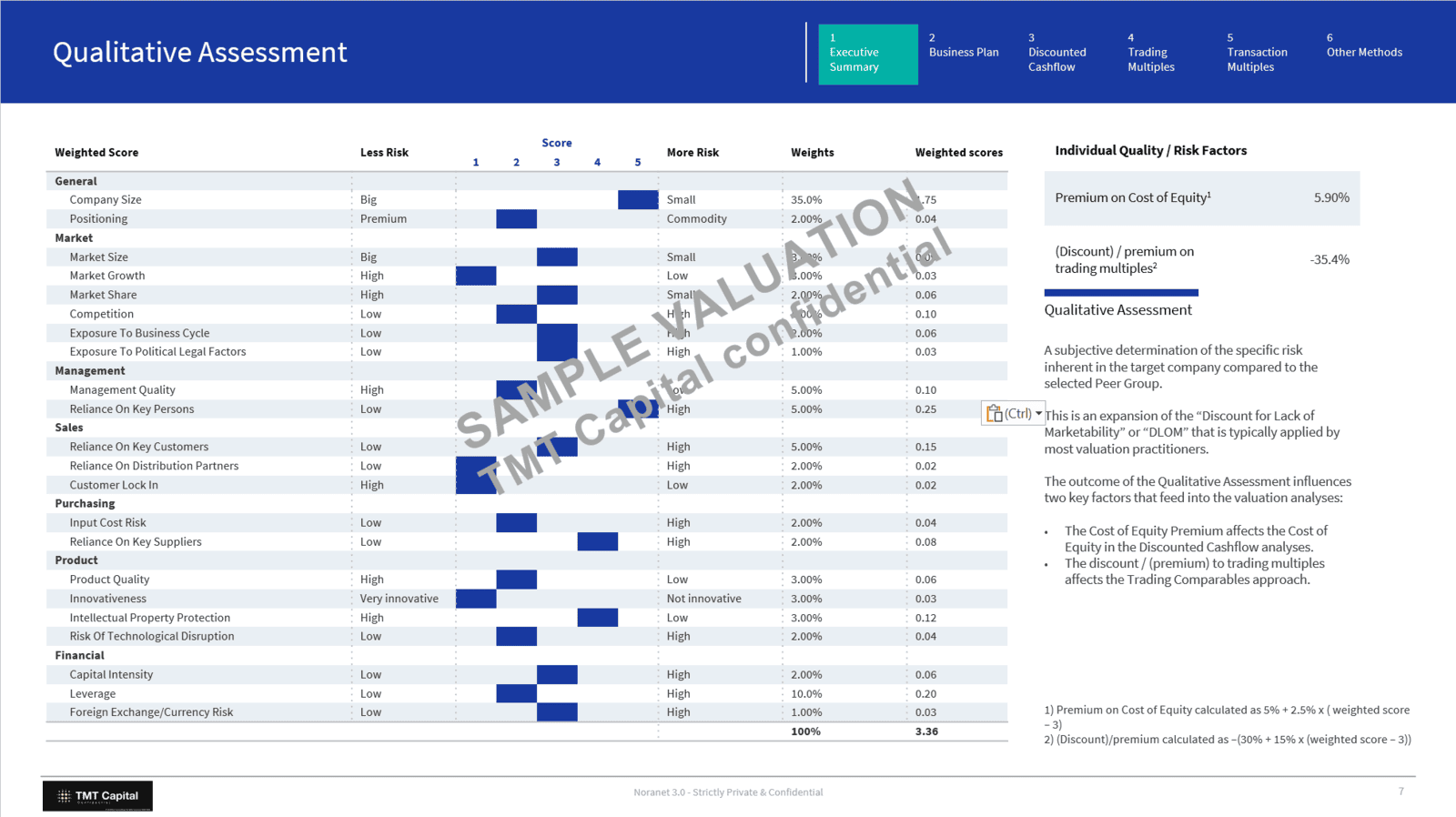

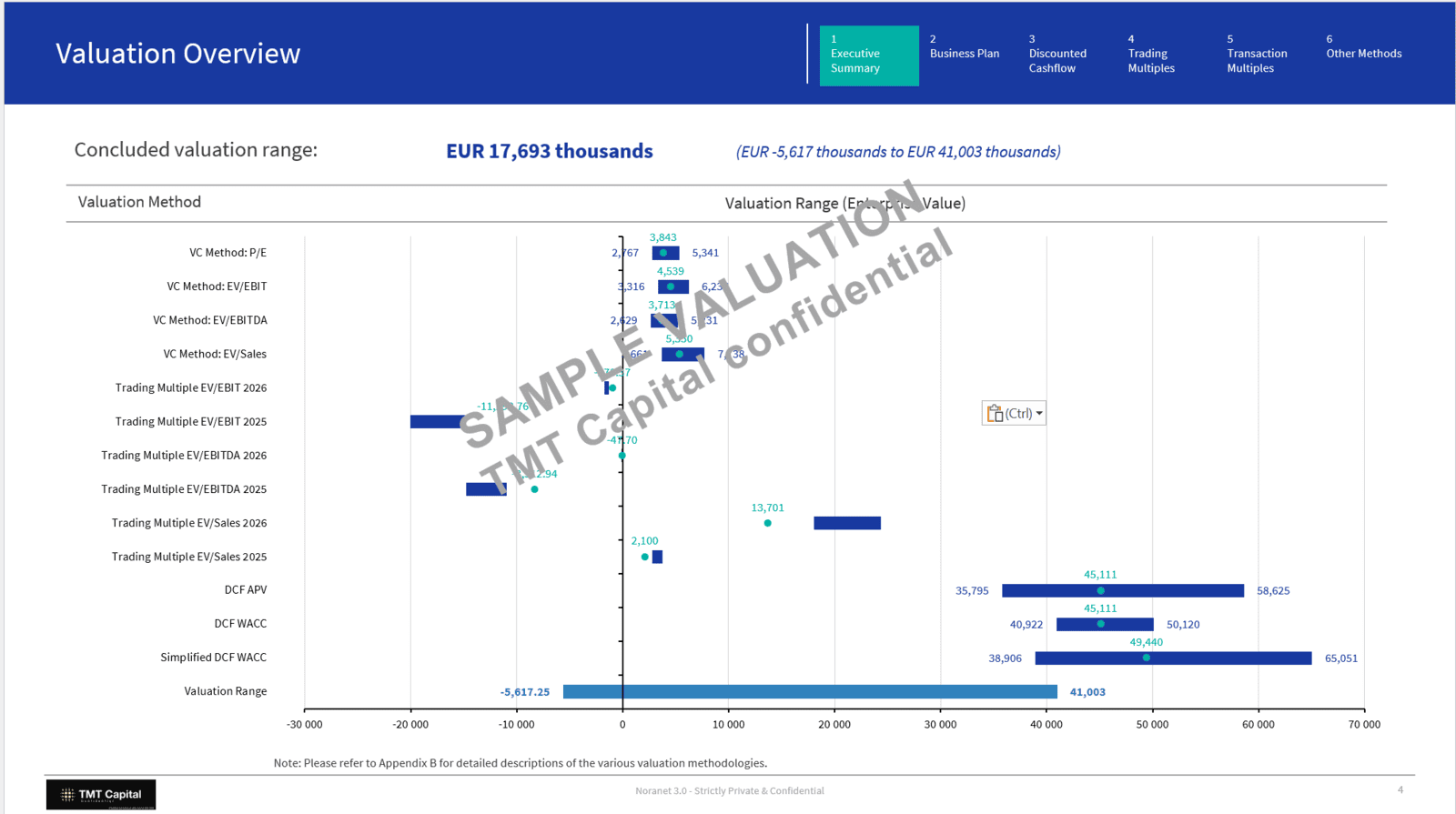

Executive Summary of EV report (8/81)